Interest rates in Ireland are rising rapidly over the past few months. Bank of Ireland’s variable interest rate at the time of writing is now sitting at 4.6% APRC. Back in mid-2022, you could have gotten yourself a variable rate of 3.15% across the majority of Irish banks.

When is it going to end? This is a question on the mind of many with mortgages and those who are looking to get on the property ladder for the first time. In this blog post, we will have a look at what the experts are saying and how this may affect your decision-making.

What the analysts expect?

Each quarter the ECB releases its ECB Survey of Professional Forecasters, which collates responses from experts employed by financial or non-financial institutions, such as economic research institutions.

Before we go through their expectations, it is important to keep in mind that nobody can predict the future and one single black swan event could change the basis of every assumption the respondents to this survey have made. That being said it is still interesting to see what direction the experts are expecting us to go in.

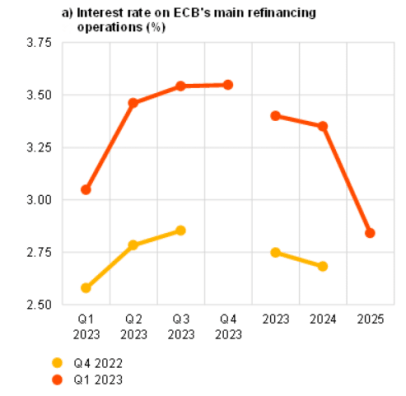

The above graphic shows the expert’s expectations that ECB key interest rate will peak at approximately 3.5% (which we have already reached) and they are expecting rates to not start to decrease again until early to mid-2024.

That being said, the experts are only expecting rates to marginally fall in 2024 to 3.25%; and a further fall of 0.50% in 2025 to 2.75%.

Note that this report was released on the 3rd of February 2023 and since the ECB followed through with a rate rise of 0.50% and inflation came down more than expected to now sit at 6.9%.

Should you fix your mortgage rates at these interest rate levels?

After initially being slow to pass on rate rises to customers, Irish banks are now more readily raising their own mortgage lending rates in response to the ECB hiking its key interest rate.

If you are on a tracker mortgage then you are already well used to seeing your mortgage rate change as of late, but for those either coming off a fixed rate soon or taking out a mortgage for the first time, is it worth fixing now at current rates or taking your chances with a variable rate?

As the ECB interest rate has risen so rapidly over the last few months, the lending market really has not had a chance to settle and for consumers to see the full extent of rate rises from Irish banks, as it can take a couple of weeks or even months for them to react.

As the banks have been slow to raise their rates, inevitably, when the ECB starts to lower their rates again, the Irish bank will also be slow to follow suit. So, even though the experts are expecting rates to drop marginally in 2024/2025, this might not have an immediate impact on borrowers (unless you are on a tracker mortgage).

Historically, when interest rates go up they don’t tend to remain at their peak for very long, so you may only have to weather the storm of excessively high-interest rates for a year or two.

If you are close to finalising your property purchase right now, you might be able to still take up some of the better deals on the market right now, which are coming in roughly at 3.4-3.8% when you decide to fix for 2-3 years.

Fixing for a long period of 5-10 years may not make sense at these current rates that are already really high – the risk is you could be missing out on any future rates being lowered in 2-3 years and have to continue paying above and beyond what you should be.

On the flip side, you will be giving yourself a lot of certainty, and if inflation suddenly rises again you will be protected against further rate rises.

Going with a variable right at this minute might not also be a wise more, as many banks have yet to fully pass on the latest ECB rate hikes and you could find yourself with an almost immediate rate increase when you first take out your mortgage. Even though a 0.5% or 1% increase in rates seems small it actually works out as a phenomenal sum of money over the life of your mortgage your mortgage.

Conclusion

Based on the expert’s predictions for the near future (which should be taken with a pinch of salt) and depending on how far along the process you are to secure your property it may make sense to fix for 2 to 3 years if you can get in very soon on a good deal.

Disclaimer: This blog post is for informational and educational purposes only and should not be construed as financial advice.