If you regularly invest in ETFs that track indices like the S&P 500, you might end up with a headache when it comes to working out what taxes you are due to pay each year in Ireland due to the complexities such as deemed disposal, FIFO, how to deal with losses, along with other peculiarities of the Irish tax system.

To try to streamline this who process for you, we have put together a template that will make the whole process more structured and easy to track from year to year.

A brief summary of how ETFs are taxed in Ireland

Just to get everyone up to speed on exactly how profits made from investing in ETFs are taxed in Ireland, here are the key points you need to be aware of:

- Taxation of Profits -if you make a profit from the sale of ETF investments in Ireland you will be taxed at a rate of 41% (Exit tax).

- Annual exemption – there is no annual exemption under the Exit tax regime

- Dividend Income – any income distributions received from distributing ETFs will also be taxed at 41% and must be included in your annual Form 11 for that tax year.

- Deemed disposal – this rule specifies that you must pay 41% exit tax on unrealised gains on the 8th anniversary of each ETF investment even if you have not sold any units of your funds.

- ETF Losses – you will only be able to offset losses between the same ETFs/UCITS (e.g a loss on one VUSA investment against another VUSA holding), but it is not allowable to offset losses against different ETFs/UCITS or other any other asset type.

- FIFO – the FIFO rule stipulates when you dispose of any assets it will also be the oldest assets that are disposed of first (First In First Out). This is very important to follow this methodology to correctly calculate your taxable gains.

This was a very brief overview but if you would like to delve into the topic a little deeper we have another blog post that you can check out that gives a longer guide to ETF investing in Ireland.

How the template works

You can register your interest in getting a copy of this tracker here.

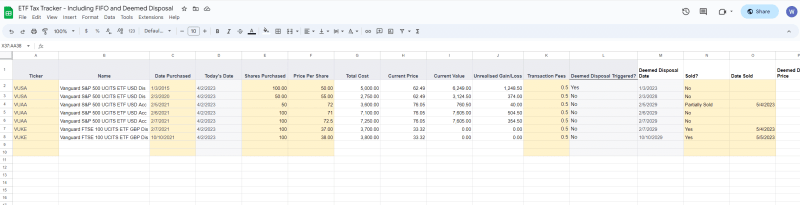

Our template is unique in that it takes into account all of the different Irish specific tax rules that we spoke about in the prior section to give you an annual snapshot of the taxes you are due to submit with your Form 11.

There are specific formula and workflows to deal with Deemed Disposal, FIFO, Dividend Income, and ETF Losses.

Summary tab:

Detailed Transaction details tab:

Dividend income tab:

How to get a copy of the template?

Due to the way Google Sheets work, there is no easy way to automatically deliver a workable copy of our template to your inbox. (But if you have any suggestions please feel free to reach out).

The first 20 people who sign up will get a free template and we may have to add a small charge after that to cover the administrative time of creating a specific template for each requestor on google and sharing it to their inbox.

You can register your interest in getting a copy of this tracker here.

Disclaimer: This blog post is for informational and educational purposes only and should not be construed as financial advice.