Let’s be honest Capital Gains tax returns in Ireland are needlessly overcomplicated for investors.

This is because in Ireland we just use one form (CG1) for every type of capital gain whether is a profit from the sale of a house, land, stocks, crypto, options and so on.

When you see how much of this form is non applicable for regular investors who just own stocks and crypto you will realise just how easy it is to complete a return all by yourself with the need of an expensive accountant.

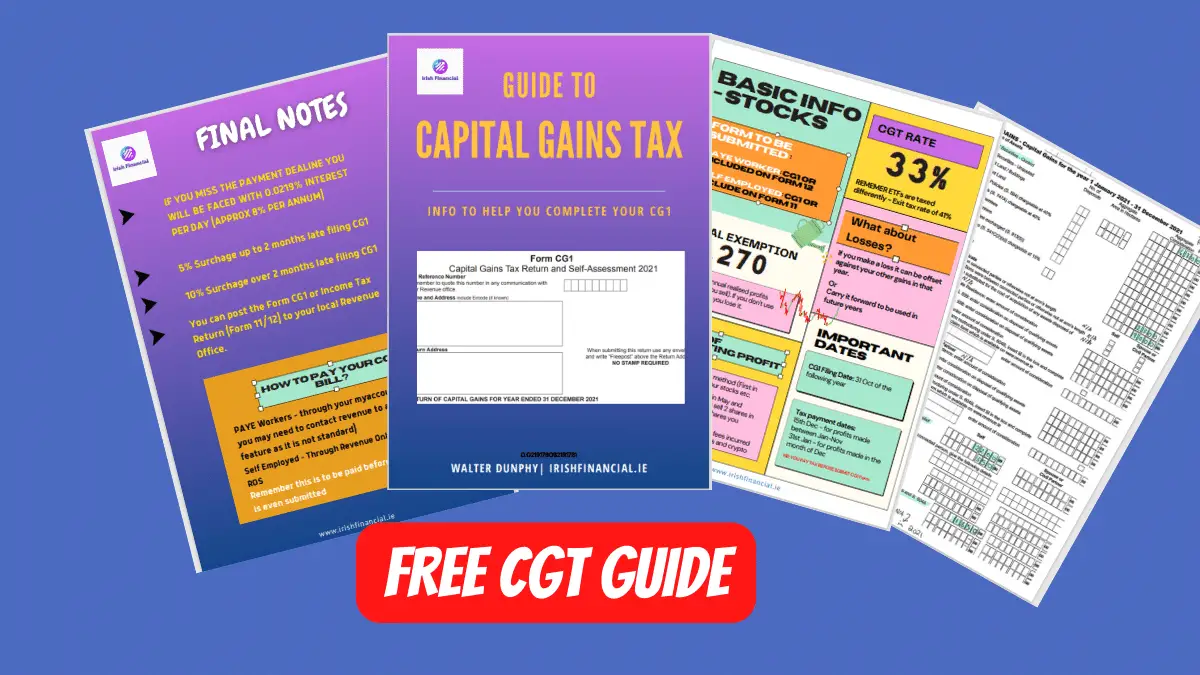

Many people see this huge lengthy form and are completely confused and intimidated by it so I have put together an educational guide that will take you from zero to doing your own Capital Gains Tax Return (CG1).

What is included in the Guide?

The 11 page guide will take you through the following:

1. All the basic info that any beginner will need to get them up to speed such as the tax rates, exemptions, forms, filing dates, payment dates, method of profit calculation, and how losses are treated.

2. Additional information specifically on the taxation of cryptocurrencies, including what is a taxable event for crypto, tax on NFTs, staking and mining.

3. Next up, we take a look at a Case study for an investor called John Murphy who just started investing in 2021 and we go through all his transactions and work out what his CGT tax bill is going to be for the 2021 financial year.

4. Most importantly, then we take our working from step 3 and plug them into the CG1 form. This will give you a real life example which you can apply to your own investments and provide you with a clear guide to what sections of the form are applicable.

5. Then finally, we go over how to pay your tax bill as well as what are the fines and penalties for missing either the tax payment date for the form filing date.

If you have an suggestions or further questions that you think should be added to the CGT guide then you can always ready out to me on any of my socials or by email (available on the About Me page)

Disclaimer: This blog post is for informational and educational purposes only and should not be construed as financial advice. The guide included in this blog post is not a substitute for financial advice and is purely an aid to help investors understand how capital gains tax returns work in Ireland.