When you register your business for VAT, you will be responsible for filing regular VAT returns with the Revenue Commissioners.

As a business owner, it’s essential to understand how often you need to submit your VAT returns to stay compliant with Irish tax laws. In this blog post, we’ll discuss what options you have, as well as what factors you will need to weigh up.

How often

When you have take the decision to register your business for VAT in Ireland, whether it be as a sole trader or a limited company, you will next have to decide how frequently you plan on submitting VAT returns to the Revenue Commissioner.

How often you submit your VAT returns to the Revenue Commissioner will be dependent on your annual VAT liability.

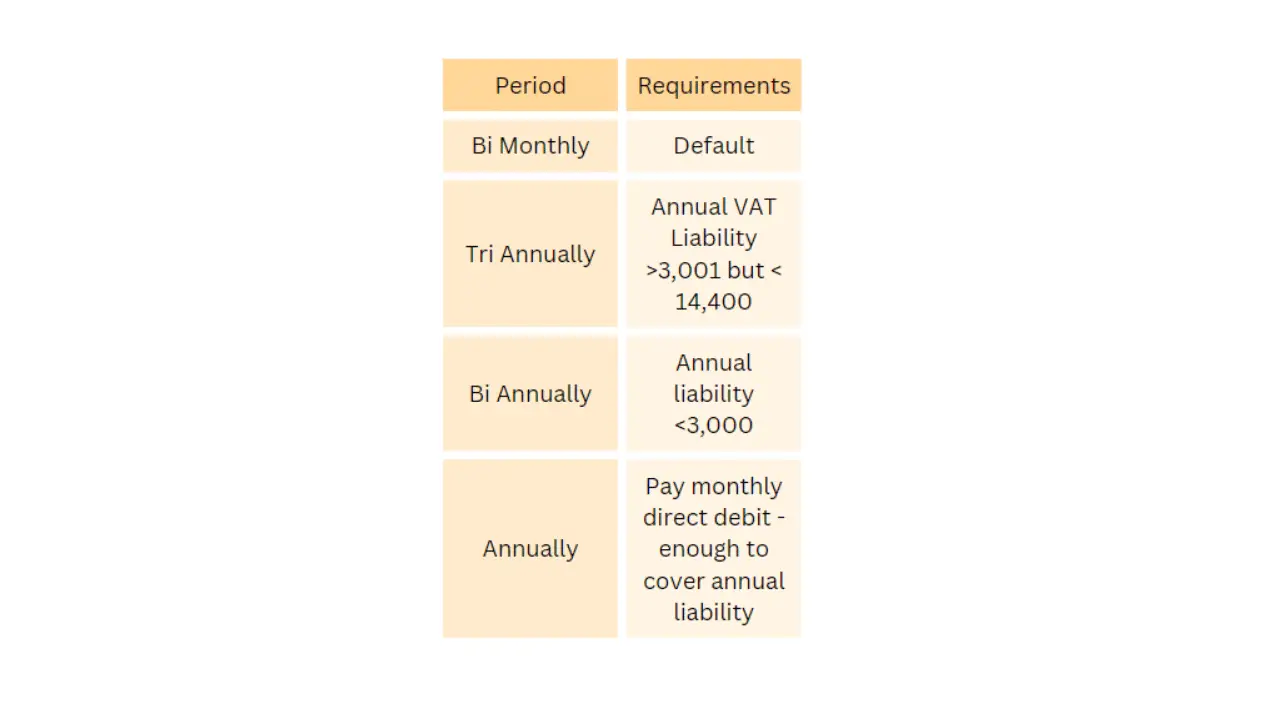

The default position of the Revenue Commissioner is that you will submit VAT returns on a bi-monthly basis. This can be altered to tri-annually, bi-annually, or annually if your annual liabilities are below certain thresholds, but will need to be requested.

As you can see from the table above, businesses with a annual VAT liability of >€3,001 and <€14,400 may choose to submit VAT returns every 4 months with the permission of the Revenue Commissioner.

If your annual liability is due to be less than €3,000 per annum then you can further extend this to submitting just 2 VAT returns per year.

Lastly, you may also take the route of paying equal monthly direct debits to the Revenue Commissioner and then completing just one annual VAT return at the end of the year.

What it the best option for your business?

You will need to weigh up both the cash impact versus the additional administration when making the decision of what is the best option for your business.

There is quite the tight turnaround for submitting your VAT returns. For example, if the VAT period was Jan-Feb 2023 you would only have until the 19th of March to submit that return if you were doing bi-monthly returns.

This means you need to have all of your ducks in a row, and be capable of preparing your accounts adequately within a short space of time. Some business owners are so caught up in the day to day, they will need to outsource this administrative task at an extra cost to the business.

On the other hand, if your business is just up and running then cash flow will be vital, some businesses are going to be in a VAT refundable position in the first few months of trading as they will have high VAT on purchases than they do VAT on sales. The longer the time period you choose to do your VAT return, then the longer it will take to be refunded these VAT repayments.

VAT registration thresholds

Just to be clear, you do not have to register to VAT until the Turnover of your business exceeds the following thresholds:

- Supply of Goods: €75,000

- Supply of Services: €37,500

- €41,000 for those making acquisitions from other EU stats

But even if your business is below these thresholds, you can still register for VAT on a voluntary basis. You will need to weigh up the pros and cons of VAT registration before jumping to any conclusions. This was further discussed in another blog post on our website – read here.

Disclaimer: This blog post is for informational and educational purposes only and should not be construed as financial advice.