The key to building long-term wealth is structuring your businesses correctly to minimise the taxes that you will pay, which allows you to reinvest profits generated and continue to compound your growth while protecting your business and personal assets.

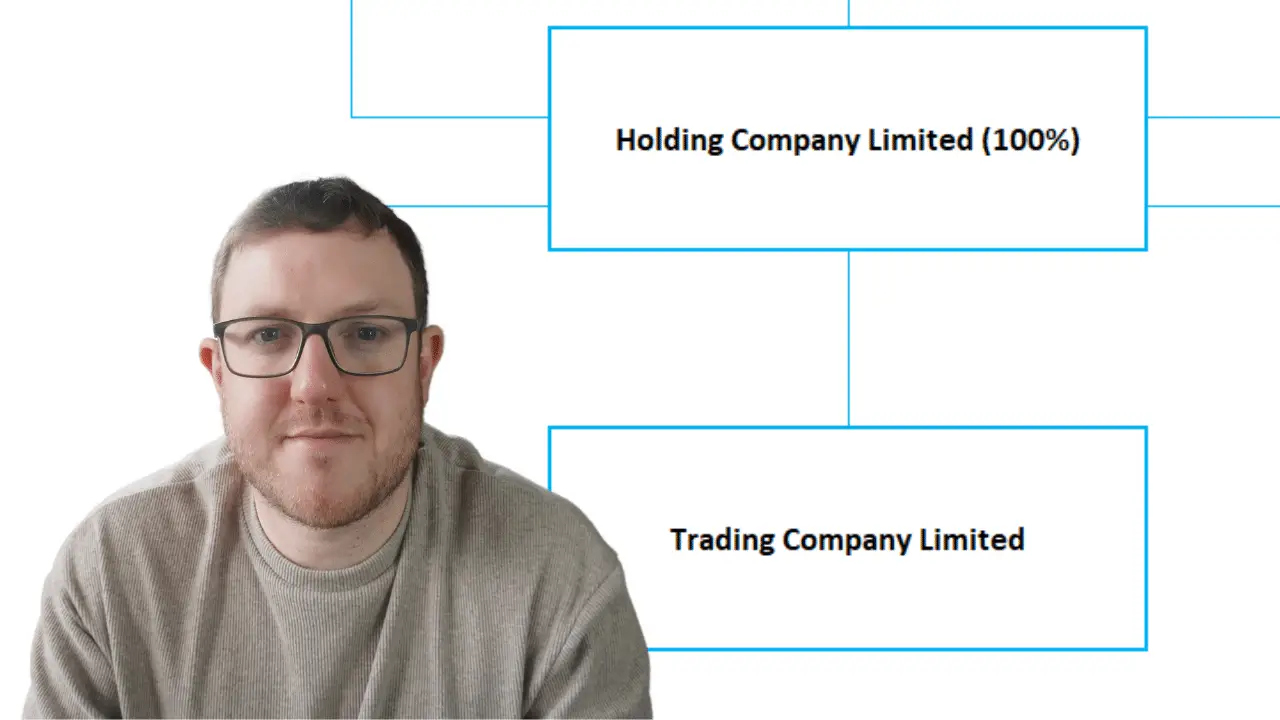

A common tactic used by many Irish businesses is to set up a holding company structure which can help you achieve all the above.

In this blog post I will give you a jargon free overview of how this all works.

What is a holding company?

A holding company is set up with the sole purpose of ‘holding’ shares in numerous different investments (trading companies).

The holding company does carry out any trading activity of its own, and the only transactions you may see on a holding company’s books relate to dividends and loans to and from subsidiaries.

Holding companies are often used for a variety of reasons, including:

- Asset protection: Holding companies can help protect the assets of a business by separating its assets and liabilities from those of its subsidiary companies.

- Tax efficiency:

- Diversification: Holding companies can provide a way for businesses to diversify their investments and spread risk across multiple subsidiaries.

- Simplification of management: By consolidating ownership of multiple companies under one parent company, holding companies can simplify management and reduce administrative costs.

Luckily there are low fees in registering an additional company in Ireland if you did want to go this route of setting up a holding company.

Tax Benefits of Holding Companies in Ireland

Capital Gains Tax Exemption

Irish holding companies can get a full capital gains tax exemption on the disposal of shares in subsidiary companies if they meet the following criteria:

- The holding company owns at least 5% of the shares in the subsidiary that are being sold for a continuous period of 12 months, anytime within the 2 years before the sale.

- The subsidiary company that is being sold is a tax resident in an EU country or a country Ireland has signed a double taxation treaty with.

- The subsidiary being sold is an active trading company.

- The subsidiary company does not derive the greater part of its value from land in Ireland, or from minerals.

The upshot of this is that it gives business owners far more options when it comes to the disposal of a trading entity.

If we take a more traditional structure that has no holding company, John and Mary Ryan own 100% of the shares in 3 different trading entities. Business is going well and they receive an offer to sell Trading entity #1 for a taxable gain of €15 million.

Once this deal is done, John and Mary have no choice but to pay 33% capital gains tax on this amount which is approx €5m. For this example, I am assuming John and Mary do not qualify for the entrepreneur relief which allows entrepreneurs to avail of a reduced capital gains tax rate of 10% up to a limit of €1m over their lifetime.

Now let us compare the situation to where John and Mary had set up a holding company structure to hold the shares in all of the trading entities.

In this scenario, the full €15m can be distributed tax-free to the holding company. John and Mary then have far more flexibility in what they do with the funds.

- The can reinvest it in Trading company #2 or #3 to try and continue to grow their wealth.

- They can pay themselves dividends from the holding company every year to sustain their living expenses, but this income will be subject to income taxes. But the tax burden is spread out over years or even decades.

- Another more extreme measure John and Mary could take is to move to zero tax jurisdiction and lose their Irish tax residency and domicile to enable them to access this income locked up in the holding company without having to pay any further tax. That is a very simplified explanation of the option that will need a significantly greater amount of tax planning.

Dividends and distributions tax exemptions

Along with the benefits of the capital gains tax exemption, there are also exemptions for corporation tax and dividend withholding tax on dividend income from other Irish resident companies.

Where a dividend is paid to an Irish tax resident company by an Irish tax resident company the recipient company is generally not chargeable to either income tax or corporation tax in respect of that dividend.

The huge advantage of this is that you can use the trading profits of one company to invest in another company without incurring any tax charges. This can be a huge tool for any entrepreneur with the ambition to exponentially grow their wealth.

Asset protection

Holding companies can be a great way to protect valuable company assets such as the property which can be owned by the holding company and leased to the trading company.

This way, if the trading entity got into financial difficulty, then the creditors would have no access to these assets in the event of a liquidation event occurs.

Conclusion

In conclusion, there are many benefits to setting up a holding company in Ireland. From tax benefits ( CGT, CT and DWT) and asset protection to investment opportunities, a holding company can be a powerful tool for growing your wealth and managing your business interests.

If you are in Ireland and looking to start a business, the benefits of setting up a holding company should not be ignored.

Disclaimer: This blog post is for informational and educational purposes only and should not be construed as financial advice.