Investing is growing ever more popular in Ireland, but until now there was no book that captured all of the peculiarities and rules that you need to be aware of as beginner investors in Ireland.

The Irish Investors’ Guidebook is jam-packed with useful information and examples to help you navigate investing in Ireland.

The Irish Investors’ Guidebook is the perfect gift for:

– People who have begun investing, but get into difficulty when it comes to figuring out what taxes they may need to pay.

– Beginner investors in Ireland looking to educate themselves on the Irish tax system.

– People who have just moved to Ireland and are looking for a way to get up to speed with how investing works in Ireland.

This book includes a full real-life example of how to complete a capital gains tax return. A CG1 form can look daunting at first, but when you see a real-life example you will realise just how easy it can be do look after your own taxes and not have to rely on an accountant.

Where to buy the Irish Investors’ Guidebook

The Irish Investors’ Guidebook is available in paperback, eBook, and on Kindle.

Paperback (€22.50 + Shipping)

Note: the paperback version is currently not available on Amazon.co.uk (bloody Brexit) but is available in Amazon.de, Amazon.com, Amazon.fr, Amazon.nl, Amazon.es.

To switch to Amazon.de or Amazon.com simply select the dropdown menu beside the flag, and select change country/region.

eBook (€15.00)

You can get your own copy of the Irish Investors’ Guidebook on the Irish Financial Store by following the below link.

Kindle (€9.99)

If you are a Kindle user, then you can pick up a copy of the Irish Investors’ Guidebook for just €9.99.

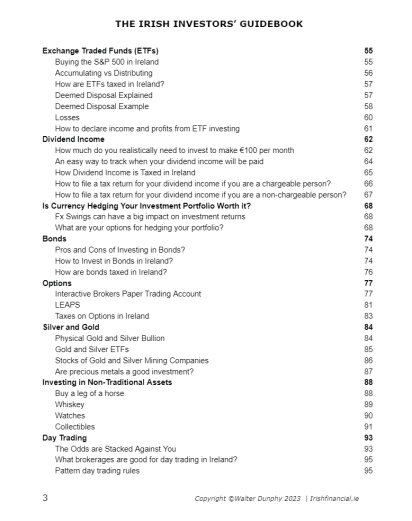

Contents

If you want to get a flavour of what the book covers, then have a ready through the contents pages supplied below.

Disclaimer: This book is solely an educational guide and is not to be construed as financial advice. For all financial decisions, please make sure to consult your financial advisor.