There are many people in Ireland that have a business idea, that get put off from every giving it a go as large accounting and other professional fees make the idea not viable financially from the get go.

In this blog post, I want to talk to you about another solution that could help you and your business minimise accounting fees

Typical Accounting Fees in your First Year of Trading

Depending on the size and complexity of your small business, and the state of your books and records you can roughly expect accounting fees as follows (although these are little conservative):

- Limited Company Registration €200-€500

- Annual Accounts Prep €500-€2,500

- Corporation Tax Returns €400-€1,000

- Payroll Processing €50-150 per month

- VAT registration and returns €250-€500

- Management Accounts €500-€2,500

- Forecast – Approx €1,500

This mean you will be facing a bill from anywhere between €4k-€9k per annum, which can be a big outlay for a small business.

An Alternative Solution to Reduce your Accounting Fees

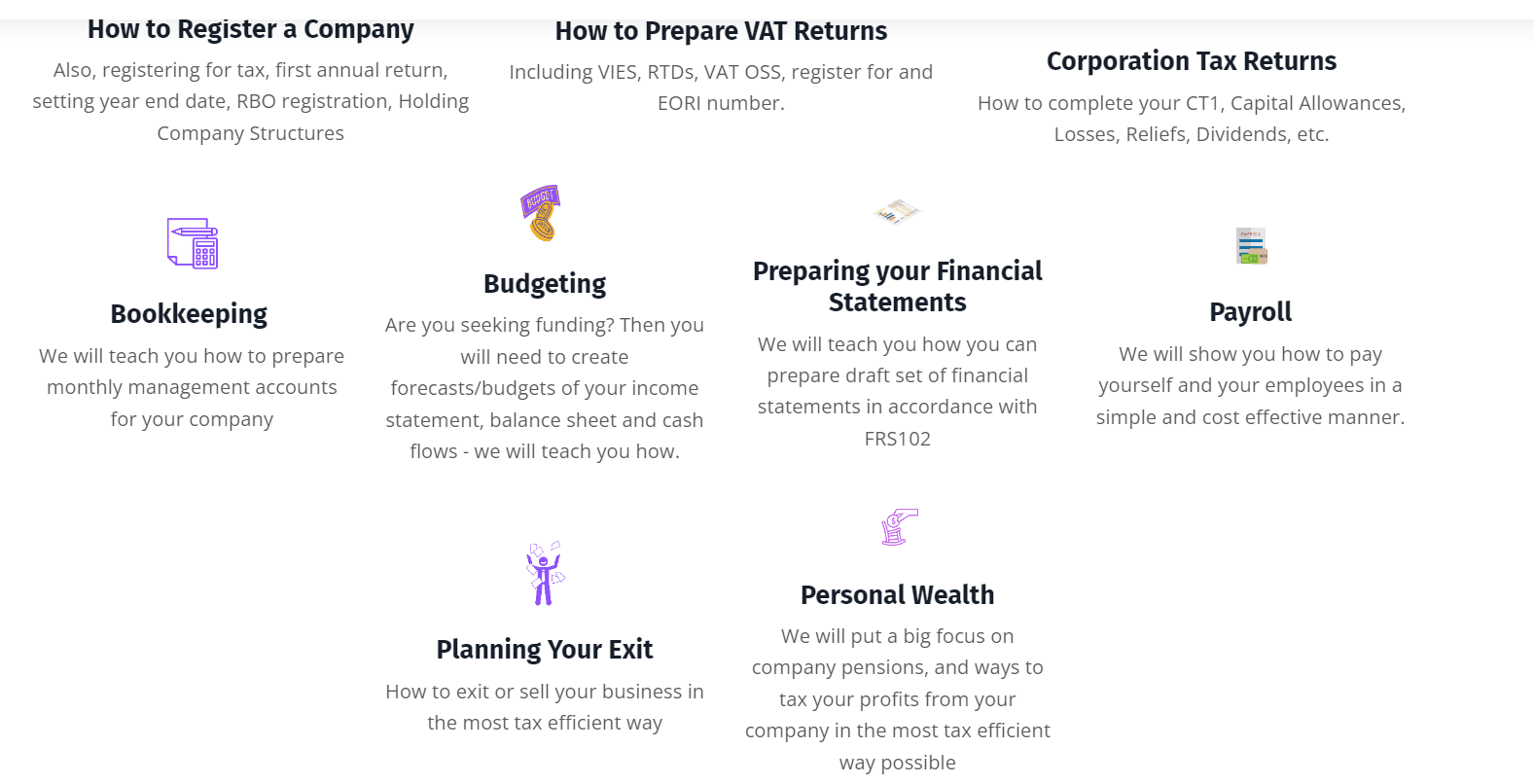

The mission of my course is to help your small business save thousands on accounting fees by giving you the tools to start your own limited company, do your own bookkeeping, payroll, VAT returns, Corporation Tax returns, CRO returns, and Financial Statements.

As well as learning about lots of vitally important topics such as holding companies, pensions, personal taxes, and many, many more topics.

Accounting fees are crazy for small businesses in Ireland right now, and with this course you can get the bulk of this tax and compliance tasks completed in house and reduce your reliance on your accountant who will then go from preparing all your your accounts and tax returns, to just being there to review all your returns for accuracy and advice.

Here is a quick snapshot of what you will learn.

Feel free to also skim through the course syllabus, which currently have over 100 videos and 11 hours + of content with many more topics and videos to come.

Community

When you join our community you will have lifetime access to the course, and as well as this you will be able to join weekly Zoom calls where you can troubleshoot all your problems with the tutor as well as your fellow small business owners.

Most importantly too, I want you to direct future content. Every week there will be new videos and tutorials added to the course and I want them to specifically address the issues you are facing so you get the most value as possible out of the course.

You Tutor

Hi, I’m Walter Dunphy,

- ACCA Qualified Accountant

- Prepared Financial Statements for 200+ Irish Ltd Companies and Sole Traders

- Set up 30+ Irish Companies for clients

- Owner of Irishfinancial.ie

- Author of ‘The Irish Investors’ Guidebook’

- Created helpful content on my YouTube channel and TikTok for over 3 years now

Questions?

If you have any questions for me about the course, you can always reach me on walterdunphy1990@gmail.com or DM me on @irishfinancial.

I am looking forward to working with you on the course.

Disclaimer: This blog post is for informational and educational purposes only and should not be construed as financial advice.