When it gets to the end of the fiscal year everyone scrambles to see how much they are going to be handing over to the taxman on profits made in that year. This often leads to a lot of creative thinking of how to try and minimise this bill as much as possible.

One question new investors ask:

Can I sell my investments that are in a loss-making situation and buy them back immediately? Thereby realising this loss in the same year as their other profits, while maintaining the exact same investment portfolio.

The simple answer to this question is you can execute these trades but the tax rules will prohibit you from benefiting from this strategy. This is an example of a wash sale. In this blog post, we will go over the definition of a wash sale, the Irish specific rules and how you can avoid being caught out by the wash sale rules in Ireland.

A wash sale is when an individual sells or trades a stock at a loss and, within 4 weeks before or after this sale, buys an identical stock, or acquires a contract or option to do so.

Tax authorities in most jurisdictions have rules set up to limit any benefits that investors can avail of by making these wash sales.

How The Wash Sale Rule Works In Ireland?

Here is the guidance as per the Revenue Commissioner in Ireland and we will go through some specific examples on how these work.

Shares bought and sold within a four-week period cannot be offset against other gains.

You can only deduct the loss from a gain made on a subsequent disposal of the same class shares acquired within the 4 weeks.

Example 1

In the first example, the investor here has bought and sold the same class of shares within 4 weeks, but they actually made a profit. There are no issues with this from a tax perspective and the normal rules apply. Losses made on other trades throughout the year, if any, may be offset against this profit.

Example 2

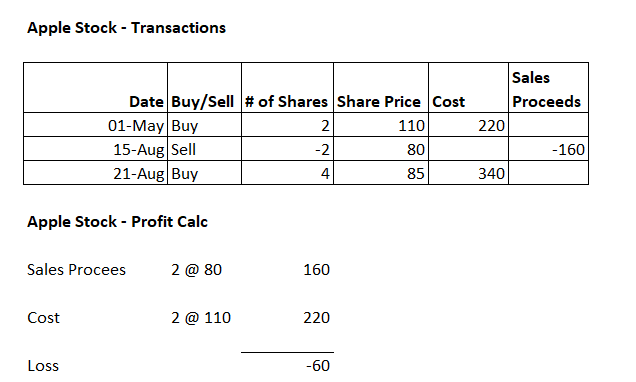

In this last example, the investor bought shares and held on to them for 3 and a half months when they disposed of them at a loss. Then a week later they bought 4 shares of the same stock again.

In this scenario, the loss they made on the original 2 shares of €60 can only be offset against any future profits they may make on the subsequent disposal of the 4 shares acquired on the 21st of August and cannot be offset against the profits on other shares in their portfolio.

How To Avoid Getting Caught Out By The Wash Sale?

If you want to manage your tax position at the end of the year the best strategy is to realise the losses you have, but do not immediately buy back into the exact same position you just disposed of until 4 weeks later. This is essentially called tax-loss harvesting.

The downside of this strategy is you will lose out on 4 weeks of potential growth in the market as you wait to rebuy your positions. If the potential tax saving is greater than what you might lose out on in market growth then economically it makes sense.

If you are selling a position that is in a profitable position there is no need to worry. It is okay to sell these and immediately rebuy as normal. This can be a very useful strategy (also called the Bed & Breakfast Sale) to maximise your annual capital gains exemption of €1,270.

In summary, you need to be careful when buying and selling stocks at a loss within a 4-week window as this distorts the usual capital gains tax rules we all are used to. A wash sale can lead to being unable to offset these losses against other realised gains.

Disclaimer: This blog post is for informational and educational purposes only and should not be construed as financial advice.

-

Pingback: Legally Avoiding Capital Gains Tax in Ireland – Bed & Breakfast Sales Strategy - IRISH FINANCIAL

-

Pingback: Legally Avoiding Capital Gains Tax in Ireland – Bed & Breakfast Sales Strategy | IRISH FINANCIAL