LEAPS (Long-Term Equity Anticipation Securities) are a popular method of investing using options among retail investors in the US. In Europe, the investing landscape is not as developed for retail investors looking to dip their toes in more complex financial instruments such as LEAPS.

So in today’s blog post, we will point you in the right direction if you are interested in learning about where you can trade LEAPS in Europe, along with some important things to consider before investing any of your hard-earned money.

Best Brokerage in Europe to give you access to LEAPS?

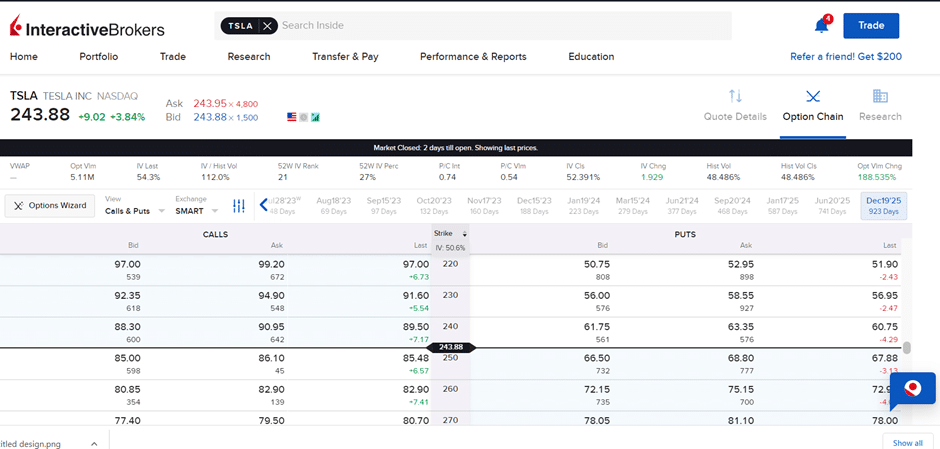

Right now, we consider Interactive Brokers by far to be the best platform to use any of the brokers operating in European markets if you want to invest using LEAPS (Long-Term Equity Anticipation Securities).

With Interactive Brokers you have the advantage of having access to US options with expirations of anywhere up to 2 ½ years.

For example, on the Tesla Options Chain, the option with the longest time to maturity at the time of writing expires on 19 Dec’25 (923 days from now).

Another great feature that Interactive Brokers have to offer is that you can start out with a Paper Trading Account and learn options in a risk-free way with fake money.

Another great feature that Interactive Brokers have to offer is that you can start out with a Paper Trading Account and learn options in a risk-free way with fake money.

Other Brokers Offering LEAPS?

Other brokerages allow you to trade with options such as LEAPS in Europe also, such as Degiro, Saxo, and Freedom24.

Degiro

The main limitation of using Degiro as your primary broker for trading options is the limited choice in options contracts. Degiro currently does not offer options on US stocks, but you can trade with some US Equity Index Options and warrants.

Saxo Bank

While Saxo Bank does have a decent level of choice when it comes to options, it is 4-5 times more expensive than Interactive Brokers. With fees of $3 per contract for US Stock Options.

Freedom24

Freedom24 is a good alternative to Interactive brokers as they can compete on price for US options at $0.65 per contract and when you take into account all of the different strikes and expirations, there are over 855,000 options available.

What Should you know about LEAPS before you invest?

As the length of time before expiration on LEAPS can range from 1 – 3 years, they tend to have certain characteristics that are important to be aware of before you invest. Some of these are potential risks, while others are advantages compared to short-term options.

LEAPS can be more costly – LEAPS have a longer time to expiration compared to shorter-term options. The longer the time to expiration, the higher the extrinsic value is.

The implied volatility of LEAPS tends to be higher compared to shorter-term options. This is because there is more time for the stock price to experience significant fluctuations, increasing the potential for larger price moves.

You could lose it all – unfortunately, if your option never goes into the money you will lose all of your initial premium paid, which makes investing using LEAPS far riskier than just buying the underlying stocks.

Liquidity can be an issue – It is not very common for option holders to exercise their options as you do not capture the remaining extrinsic value. It can be far more common to resell your option on the market, but when you invest in options with such a long expiry you could face liquidity issues and not be able to close your position and realise your gains or losses. This could leave you in a situation where you cash it locked up for a very long time.

Less volatile – LEAPS are however less volatile than short-term options as they tend to have higher Deltas (typically 0.8 or higher) and the price of the option moves more in line with the underlying stock than short-term options. Therefore, if the stock price increases by $1, the option price would increase by $0.80.

Disclaimer: This blog post is for informational and educational purposes only and should not be construed as financial advice.