Are you a complete newbie when it comes to investing, or looking to try out a new type of financial instrument you have never used before? Often the hardest part of beginning to invest is the fear that you could make a huge costly mistake. That fear can be debilitating and mean that many people never begin investing in the first place.

Well then you’ll be glad to hear Interactive Brokers have a solution that can help to alleviate those fears and build your knowledge and expertise in a risk free environment.

Interactive Brokers have a Paper Trading Account that allows you to simulate real life investing, so you can learn in a safe environment without the risk of losing any of your personal funds. In this blog post, we will show you how to set up a Paper Trading Account and some other important info.

Need to Knows When it Comes to Setting up your Paper Trading Account on Interactive Brokers

In order, to access a Paper Trading Account with Interactive Brokers you will firstly need to sign up for one of their regular trading accounts, which involves following the usual account setup process, KYC, and funding your account (note the process may differ from market to market).

Once you have your regular trading account set up, follow these steps to activate your Paper Trading Account:

1. Log in to Account Management.

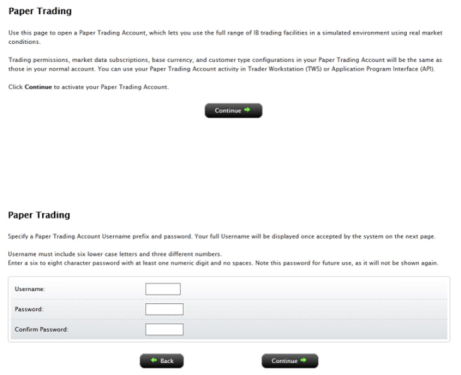

2. Click Manage Account > Settings > Paper Trading.

3. Click Continue once the following screen appears

4. Type a five-character paper trading account username in the field provided.

5.Type a paper trading account password in the field provided. The password must be from six to eight characters and must contain at least one number and no spaces.

6. Re-type the password in the field provided, then click Continue. The system will generate a full username for you when you click Continue.

7. You are prompted to click Yes to confirm your request for a paper trading account, or click No to cancel your request.

Be sure to write down your username and password; your password will not be shown on the screen again.

The way your Paper Trading Account will be configured will depend on what level of access to different financial instruments you will have on your regular trading account – the mapping will be the same for both.

From the time of request it will take 24 hours for your Paper Trading Account to be activated.

Your Paper Trading Account will be credited with $1,000,000 in funding, which you can trade freely with just like in a real life scenario.

Tips for using your Paper Trading Account

The whole idea of having a Paper Trading Account is to prepare you for real life investing. However, your account has $1,000,000 from the get go, and this can be where things get unrealistic really fast.

Unless you are awash with capital and have $1,000,000 to invest then you should try and stick to trading with the same amount of of capital that you will in real life. As when you have a huge amount of capital at your disposal, your options are far greater.

For example, 1 Tesla Call Options contract expiring on 15 Dec 23 at a strike price of $215 will cost you $3,520 in option premiums + fees. This may exclude many people from trading Tesla options in real life due to the high cost. There would be no point in trading with these types of options if you won’t have sufficient capital to do so in real life (apart from a learning experience of course).

The main advantage of having the Paper Trading Account is that it does allow you to get used to new types of financial instruments you may have limited experience with such as options. For example you may want to start selling put options to earn passive income but need to execute it in a risk free way to get comfortable with this strategy before executing it on your regular trading account.

Follow my Options Learning Journey

I myself am currently on a journey of building more practical experience when it comes to using Options as part of my everyday investing strategy. Over a decade ago I learned all about the theory side of Options during my Economics and Finance Major, but never put this into practice – until now.

I will be putting out bite sized videos on my YouTube channel, starting from the basics and building from there covering all things from how options are priced, the Greeks, different options trading strategies, and many more interesting topics.

If you are interested in following along and learning with me and many others, then you can see these videos on my YouTube channel, where I will have a dedicated playlist solely for this.

Disclaimer: This blog post is for informational and educational purposes only and should not be construed as financial advice.